Billionaire Spends Millions to Gut Public Pensions

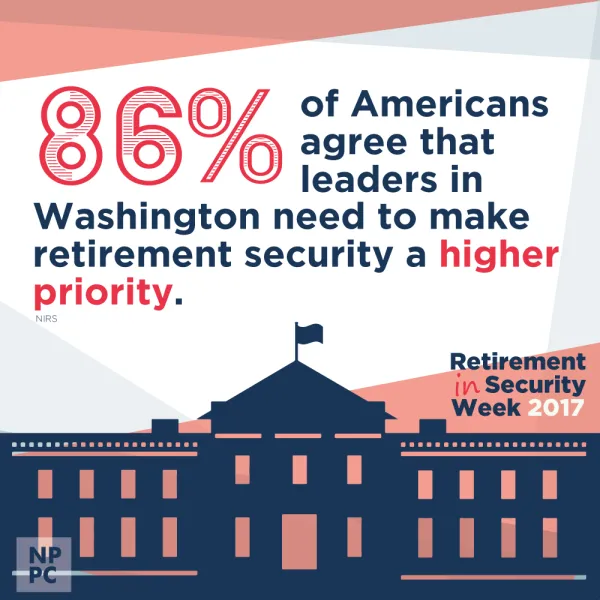

Hardworking Americans’ right to retire with dignity is in danger because billionaires are spending a lot of money to take away our pensions.

John Arnold is one of the worst offenders. He’s a former Enron trader who’s spent $50 million of his own fortune trying to gut retirement security nationally. Enron’s implosion caused billions of dollars of losses to its workers and their families, including a $1.5 billion hit to public pension assets. Yet Arnold escaped with an $8 million bonus right before the crash.

Now he’s turned his attention to public pensions. Arnold funds ballot initiatives, tainted research, lobbying and political campaigns to eliminate traditional pensions that retirees can count on.

Through his Laura and John Arnold Foundation and its policy advocacy arm, Action Now Initiative, he has spent money:

- Convincing cities and states to cut employee pension benefits.

- Donating to right-wing think tanks to do “research” that advocates for eliminating public pensions.

- Giving almost $10 million to Pew to do the same, according to the National Public Pension Coalition.

- Spending $3.5 million on a PBS series on hundreds of stations that promoted cuts to public employee pensions (which the PBS affiliate had to return due to the conflict of interest).

Arnold keeps trying to manufacture a pension crisis and to give fake ammo to some GOP lawmakers determined to cut pensions.

Except in Minnesota, that crisis isn’t real:

- While public pensions were hit by the Recession like everything else was, they are recovering nicely. Pension reforms and strong investment returns have stabilized our pension funds. The three systems (MSRS, PERA and TRA) have $63 billion in assets, so there’s no need to panic.

- Pensions are mostly funded by the workers themselves and by investment returns. Minnesota taxpayers pay for only 15 cents on every dollar in public pension benefits; the remaining 85 cents comes from employee contributions and investment returns.

- That tax money comes back to the public: Every dollar that goes into a pension fund generates $9.98 that’s spent in our communities.

While some GOP lawmakers keep trying to gut public workers’ retirements, they’re ignoring an obvious funding source, one that doesn’t rely on decades of employees’ hard work. States and cities spend $80 billion a year on corporate subsidies. That’s more than enough to make up any shortfall in pension funding and then some, according to David Sirota’s report “The Plot Against Pensions.”

Pushing people out of traditional pensions into a 401(k) is not the answer. The Economic Policy Institute reports that nearly half of working-age families in 2013 had nothing saved for retirement; the median family had only $5,000.

What kind of dignity in retirement does that provide?

Public employees have worked hard for years for their pensions. They’ve been promised them, and they’ve earned them.

AFSCME members will keep fighting for secure retirements for our fellow union members, and for all workers.

Learn more about John Arnold in this animated short.

Learn more about public pensions at publicpensions.org.